Cash register, B2B, or a credit company. Small business, franchise, or a large corporation. No matter which one you’re involved in, you already know you have unique requirements for payment processing.

Cash register, B2B, or a credit company. Small business, franchise, or a large corporation. No matter which one you’re involved in, you already know you have unique requirements for payment processing.

Perhaps, it’s just as simple as providing credit card and debit card processing for your customers who walk into your business, or maybe you need E-Commerce solutions to sell products and/or services online. With the advent of smartphones, mobile payments have also become a preferred way to conduct business in-store, at the office, or on the road at trade shows, events, and more.

Whether you need one of these services or a combination thereof, the expertise of a reliable merchant services provider is vital to choose the best technology for secure payments. That’s because every time someone swipes or inserts a credit card, a rapid exchange of digital communication between the merchant and issuing bank takes place that can leave cardholders vulnerable to fraud. Not to mention, putting a stain on your reputation for losing data. It happens all the time, even to big players like Target, Home Depot, and Wendy’s. These large corporations are among the many businesses that suffered data breaches in the past decade.

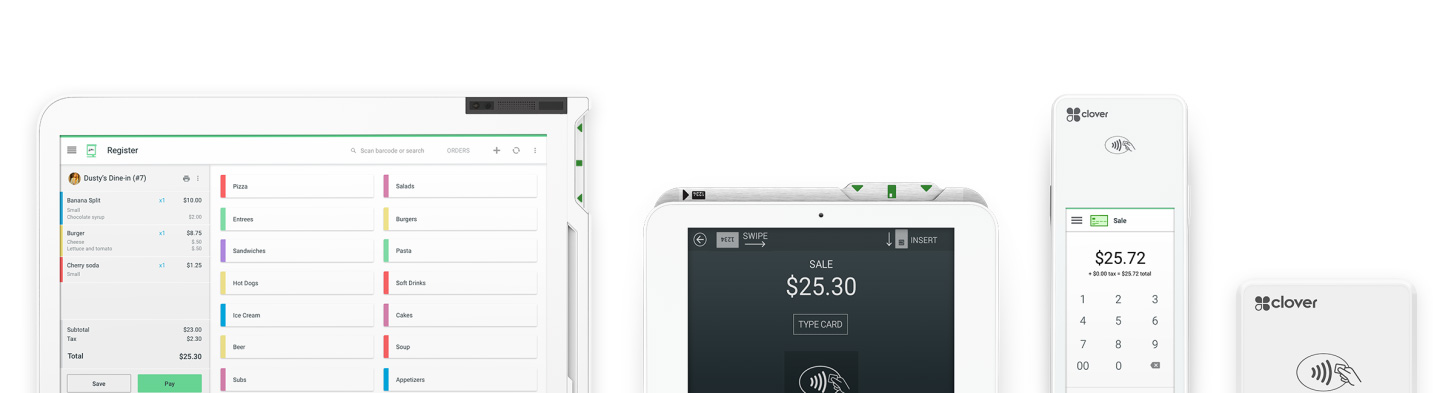

No matter whether your business is large or small, the first step to ensure security is to choose a Point-of-Sale System that prevents unauthorized access to hackers looking to steal customers’ personal information. One point of sale system we highly recommend is the Clover POS. It features the right mix of hardware with stationary and portable devices, paired with the right mix of software for superior functionality. Fully customizable with a variety of accessories, Clover POS can help you process more payments, manage your orders, oversee your team, and grow your customer base.

During the global health pandemic, Clover POS has also been able to help businesses shift seamlessly to online ordering for a contactless experience with complete mobility for curbside or delivery options. With so many customizable features, Clover POS can be adjusted to your ever-changing payment processing needs quickly and efficiently.

With that said, there can still be some level of risk with any POS system as technology continues to evolve. That’s why we recommend for the most protection, you consider adding an encryption component. As part of your merchant services system, PCI Certified Point to Point Encryption plays a pivotal role in securely processing payment transactions with data encryption taking place directly at the point of interaction. That makes it virtually impossible for thieves to access your data, and leave your valued customers and clients vulnerable to fraud.

At Card Connect Goldcoast, we offer the latest processing terminal and gateways to ensure ultimate compatibility and security with point-to-point encryption, processing interchange optimization, and patented tokenization. All designed to be easily integrated into any industry from retail to restaurants, hotels, healthcare, automotive, service providers, and more, click on “merchant benefits” on our home page to learn more. You may also contact us by phone at (800) 823-2131. Merchant accounts, credit card processing, universal commerce, point-of-sale (POS), payment processing, encryption. At Card Connect Goldcoast, we do it all.

You’ve likely heard the phrase, “Cash is King”, but that may no longer be true. While the age-old saying was originally used to convey the need to have “a cash reserve” to avoid ruin during times of crisis, with the advent of loans, store accounts and promissory notes, accepting cash became the preferred payment for property, goods and services to protect against default. For many businesses, it seemed like a “no brainer”, but that was before technology began to dominate.

You’ve likely heard the phrase, “Cash is King”, but that may no longer be true. While the age-old saying was originally used to convey the need to have “a cash reserve” to avoid ruin during times of crisis, with the advent of loans, store accounts and promissory notes, accepting cash became the preferred payment for property, goods and services to protect against default. For many businesses, it seemed like a “no brainer”, but that was before technology began to dominate.

“We accept credit cards

“We accept credit cards

Every time a customer taps, inserts or swipes a credit card, card associations like Visa and Mastercard jump in to facilitate the transfer of funds from the card’s issuing bank to the acquiring bank. For this service, these card associations collect “an interchange fee” from the acquiring bank which then goes to the issuing bank. Well then, how does Visa or Mastercard make their money? They collect something called a “network fee” which averages around 0.05% per transaction. Much smaller than the 0.2 % or higher interchange fee the issuing banks receive, it still keeps them in business with billions of transactions processed each year. Using Visa and Mastercard as an example, it’s important to note that Discover conducts business in a similar way as does American Express with a slight variation in terminology. Amex calls their “interchange fee” a “discount rate” and with more premium credit cards in their portfolio, generally charges a higher percentage on credit card transactions. Standard interchange fees and discount rates vary, with detailed information available by clicking the links below.

Every time a customer taps, inserts or swipes a credit card, card associations like Visa and Mastercard jump in to facilitate the transfer of funds from the card’s issuing bank to the acquiring bank. For this service, these card associations collect “an interchange fee” from the acquiring bank which then goes to the issuing bank. Well then, how does Visa or Mastercard make their money? They collect something called a “network fee” which averages around 0.05% per transaction. Much smaller than the 0.2 % or higher interchange fee the issuing banks receive, it still keeps them in business with billions of transactions processed each year. Using Visa and Mastercard as an example, it’s important to note that Discover conducts business in a similar way as does American Express with a slight variation in terminology. Amex calls their “interchange fee” a “discount rate” and with more premium credit cards in their portfolio, generally charges a higher percentage on credit card transactions. Standard interchange fees and discount rates vary, with detailed information available by clicking the links below.